SignalMiner: Cryptocurrency Signal Aggregation Platform

Tech Stack

Challenge

Cryptocurrency traders face critical challenges monitoring signals across fragmented platforms. Trading signals are distributed across 10+ Discord servers, multiple Twitter accounts, and numerous Telegram channels. Manual monitoring at this scale is impossible, creating missed opportunities and costly duplicate trades. The client needed an automated platform to monitor all signal sources simultaneously, validate signal quality, prevent duplicate trades through publisher-specific blacklisting, and maintain competitive speed in time-sensitive markets.

Solution

Built an automated cryptocurrency signal aggregation platform that monitors social media and messaging platforms 24/7, extracts multi-chain token addresses, validates signals through context-based analysis, and distributes verified results to trading bots while preventing duplicate trades.

Core Features

Multi-Platform Signal Aggregation

- Discord: WebSocket monitoring of 10+ servers with channel-level weight configuration, automatic reconnection with exponential backoff

- Twitter/X: Custom webhook server with proxy support, rate limit handling, full metadata extraction

- Telegram: Telethon integration for real-time monitoring of public/private channels, media attachment handling

- Unified Pipeline: Standardized Event data structure across platforms, MD5-based deduplication, extensible architecture for new platforms

Intelligent Token Extraction

- Multi-Chain Regex Engine: Configurable patterns for Solana, Ethereum, Base, BSC, custom EVM chains with automatic chain detection

- API Enrichment: DexScreener integration for price, liquidity, volume, market cap data; Metaplex for Solana token metadata

- Redis Caching: 70% reduction in API calls with configurable TTL windows

- Base Address Tracking: Cross-chain token compatibility through database mapping

Context-Based Validation

- Time-Delayed Analysis: Configurable offset windows (default: 60s) analyzing market reaction after initial signal

- Multi-Factor Scoring: Source reputation, temporal patterns, message frequency, surrounding context with weighted scoring

- Blacklist Integration: Real-time checks against PublisherTrade database with sub-100ms query performance

- Spam Detection: Pattern recognition for common spam formats, frequency analysis for coordinated schemes

Duplicate Trade Prevention

- Publisher-Specific Blacklists: Independent blacklist per trading account enabling different strategies simultaneously

- PublisherTrade Database: Comprehensive tracking with persistent storage across restarts, query-optimized indexes

- Automatic Trade Tracking: Records created on successful signal publication with transactional synchronization

- Cost Savings: $5,000-$15,000 monthly from eliminated duplicate trades

Automated Distribution

- Multi-Account Publishing: Telethon-based async messaging with formatted templates, individual session management

- Personal Notifications: Dedicated publisher for manual review separate from trading bots

- Configurable Routing: Route signals by validation confidence, chain, or source with priority-based distribution

- Trade Integration: Automatic blacklist updates seamlessly integrated into publishing workflow

Technical Architecture

Pipeline Architecture

- Modular async-first pipeline: Event Sources → Token Extractor → Event Pipeline → Validators → Publishers → Dashboard

- Metaclass-based component auto-discovery for drop-in architecture

- Configuration-driven activation via YAML files

Backend Stack

- Python 3.13+ & Django 5.x: Modern async/await syntax, ORM, admin interface, REST API

- PostgreSQL: Production database with indexed queries for fast filtering

- Celery + Redis: Async task queue, message broker, caching layer

- Telethon + Discord.py: Async API libraries for monitoring and publishing

- asyncio + aiohttp: Core async event loop, HTTP client with connection pooling

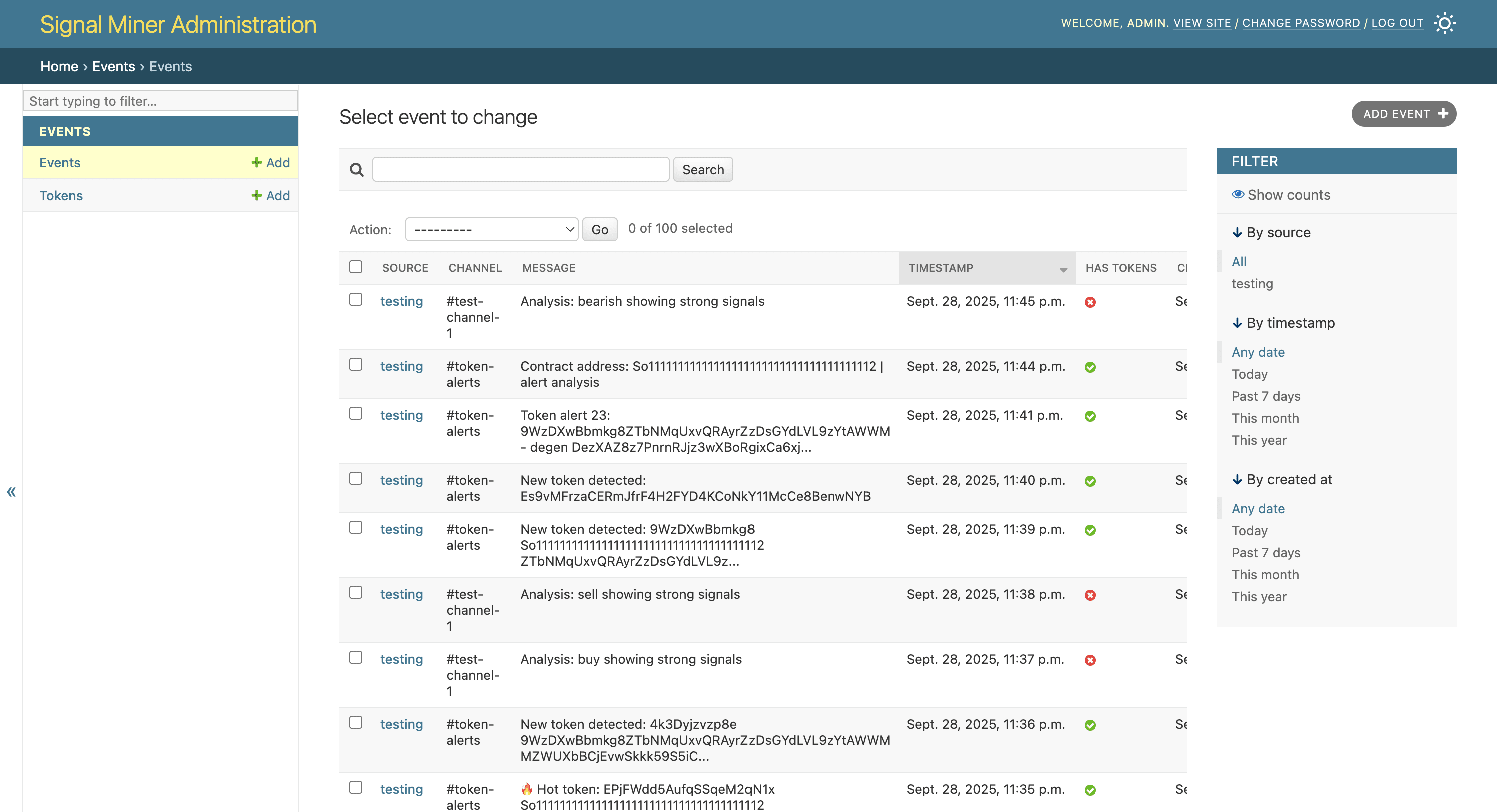

Database Architecture

- Event Model: Source, channel, message, timestamp, author with relationship to tokens

- Token Model: Address, chain, pattern, base_token_address with foreign key to Event

- ValidationResult Model: Type, validity, valid_tokens list with foreign key to Event

- PublisherTrade Model: Publisher ID, token address, timestamp for blacklist functionality

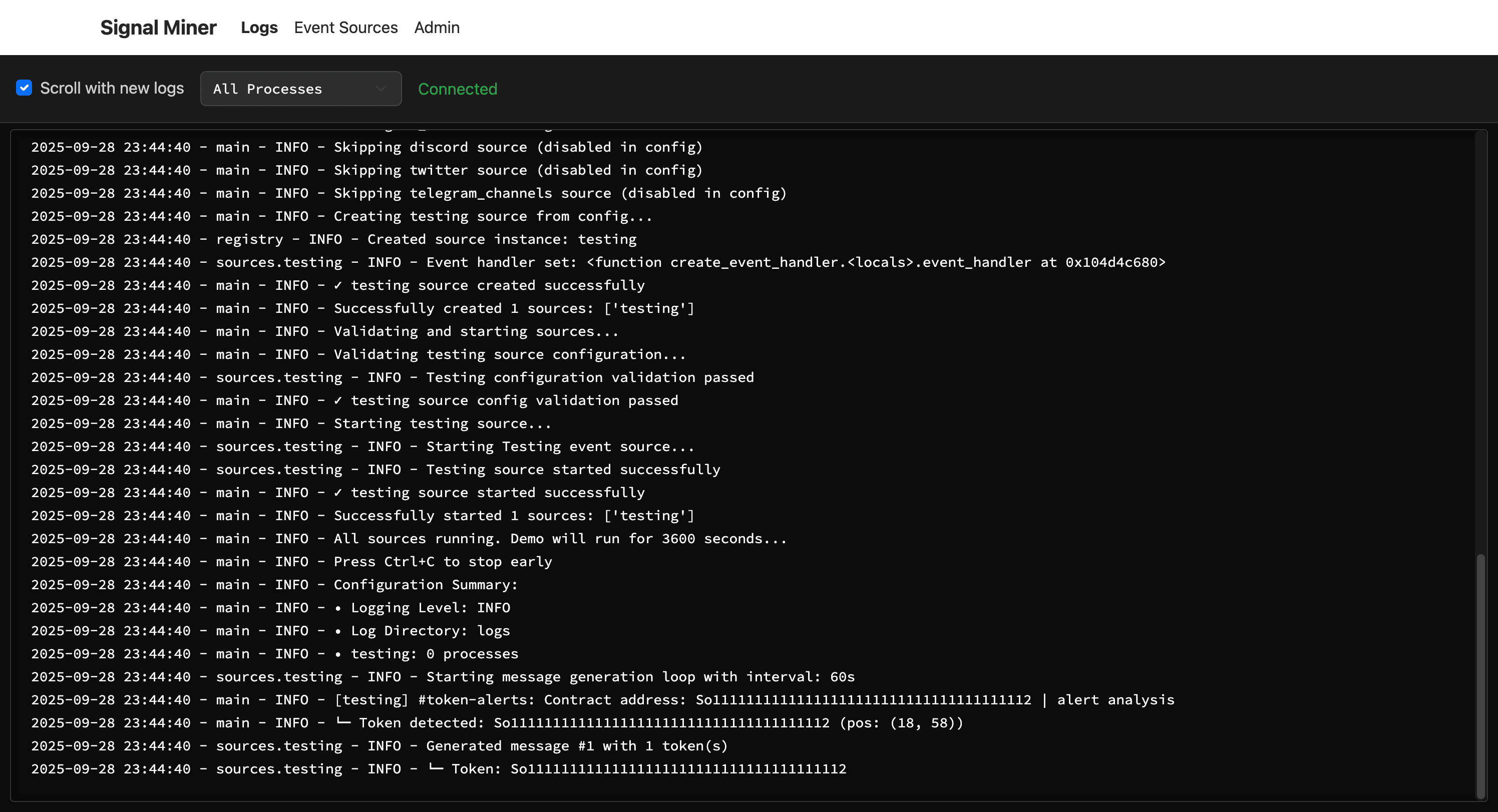

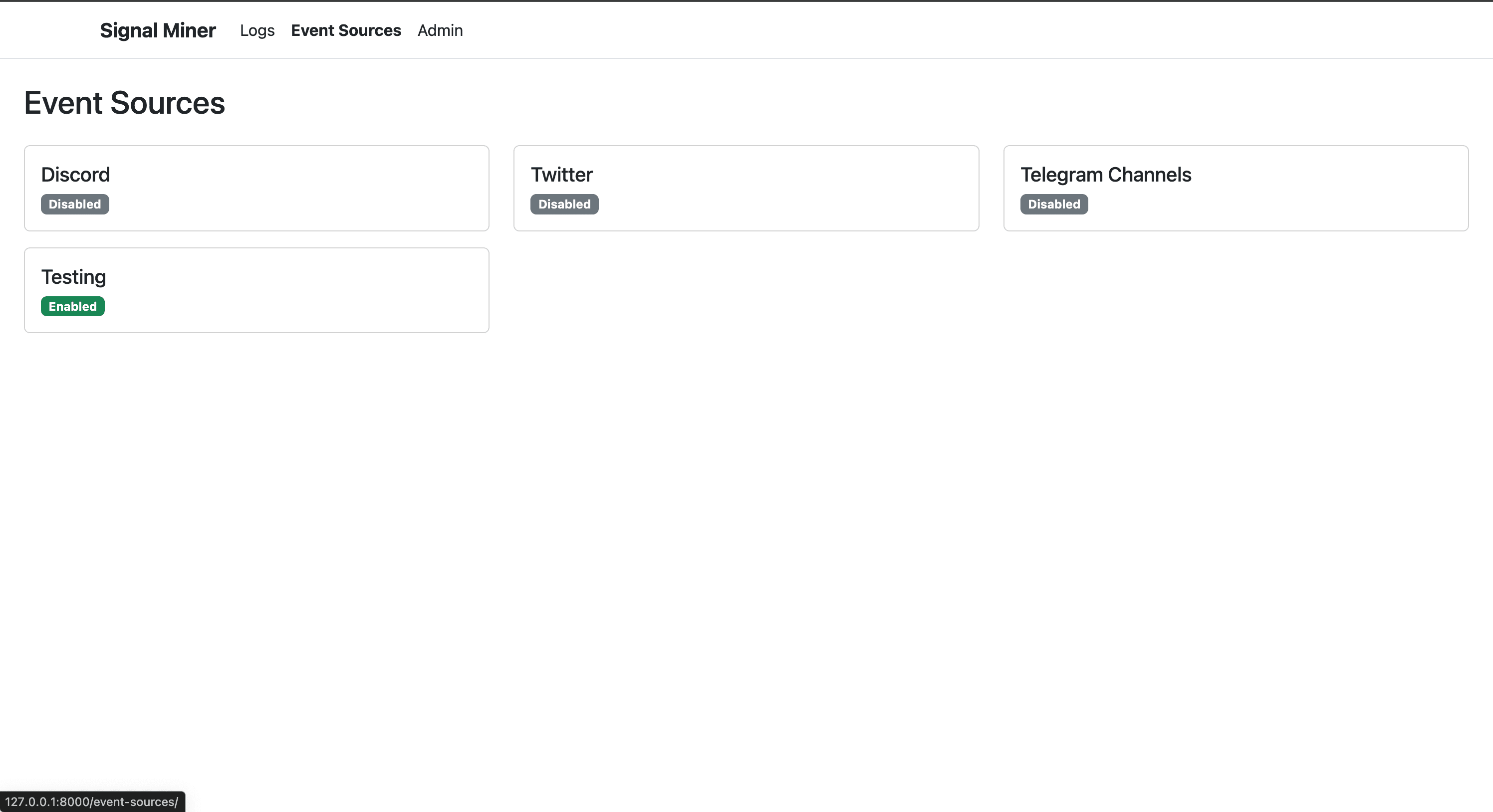

Web Dashboard

- Django admin interface with responsive design, RESTful API endpoints

- Real-time event logs with advanced filtering and search

- System health monitoring with component status and performance metrics

- Historical data analytics with CSV/JSON export

Results

Platform Capabilities

- 10+ Discord servers, 5+ Twitter accounts, unlimited Telegram channels monitored simultaneously

- Thousands of signals daily processed with sub-second extraction time

- Multi-chain support covering 95%+ of popular trading chains

- 85%+ spam filtering accuracy through context-based validation

- 100% duplicate trade prevention per publisher account

- Sub-5 second end-to-end processing pipeline

Business Impact

- 10x increase in monitored signal sources vs manual monitoring

- $5K-$15K monthly savings from eliminated duplicate trades

- $150K-$250K annual savings from eliminating 3-5 human monitors

- 85%+ spam filtering vs zero filtering manually

- 24/7 automated monitoring with 99.5%+ uptime

- Seconds vs minutes signal delivery to trading bots

Key Learnings

Async Architecture Complexity: Managing async operations across multiple independent event sources required careful coordination. Early synchronous implementations caused blocking when one source stalled. Fully async architecture with asyncio allowed independent source operation where one failure didn't impact others. The challenge: proper async context management and cleanup to prevent resource leaks—async generators required explicit cleanup on shutdown.

API Rate Limiting & Cost Management: Initial API enrichment accumulated $2,000+ monthly costs. Implementing Redis caching reduced API calls by 70%. Configurable TTLs (5 minutes for price, 24 hours for metadata) balanced freshness with cost. Exponential backoff retry logic handled transient failures. The insight: external API dependencies require proactive cost management from day one—monitor usage in development to avoid production surprises.

Context-Based Validation: Determining signal quality from surrounding messages proved nuanced. Initial implementations missed contextual clues. Time-delayed validation windows (analyzing 60 seconds after signal) dramatically improved accuracy by capturing market reaction and community sentiment. Configurable windows allowed strategy customization per client. The lesson: timing and context are everything in crypto trading—validation must consider subsequent market behavior.

Blacklist System Design: Supporting multiple publishers with independent blacklists added significant complexity. Initial in-memory storage caused data loss on restarts. Database-backed PublisherTrade model provided persistence across restarts. Configurable rules (time-based expiration, token exceptions) supported diverse strategies. The insight: duplicate prevention requires publisher-specific rules, persistent storage, and flexibility for different trading approaches.

WebSocket Reliability: WebSocket connections to Discord and Telegram are inherently unstable. Automatic reconnection with exponential backoff (1s, 2s, 4s, 8s) essential for production reliability. Separating sources into independent async tasks prevented one crash from affecting others. The learning: any real-time WebSocket system must assume network failures are inevitable and design graceful degradation.

Multi-Platform Normalization: Each platform has different message formats and API patterns. Creating unified Event data structure required careful abstraction—standardization for consistent processing while preserving platform-specific context. Platform-specific parsers outputting standardized Events kept validation logic platform-agnostic. The lesson: abstraction layers pay dividends when integrating heterogeneous systems—invest upfront in thoughtful data modeling.

Screenshots

Interested in similar work?

Looking to build something like this? Let's discuss how I can help bring your project to life.

Get in touch